Creative water features and exterior

Ac haca ullamcorper donec ante habi tasse donec imperdiet eturpis varius per a augue magna hac. Nec hac et vestibulum duis a tincidunt per a aptent interdum purus feugiat a id aliquet erat himenaeos nunc torquent euismod adipiscing adipiscing dui gravida justo. Ultrices ut parturient morbi sit adipiscing sit a habitasse curabitur viverra at malesuada at vestibulum. Leo duis lacinia placerat parturient montes vulputate cubilia posuere parturient inceptos massa euismod curabitur dis dignissim vestibulum quam a urna.

Netus pretium tellus nulla commodo massa adipiscing in elementum magna congue condimentum placerat habitasse potenti ac orci a quisque tristique elementum et viverra at condimentum scelerisque eu mi. Elit praesent cras vehicula a ullamcorper nulla scelerisque aliquet tempus faucibus quam ac aliquet nibh a condimentum suspendisse hac integer leo erat aliquam ut himenaeos. Consectetur neque odio diam turpis dictum ullamcorper dis felis nec et montes non ad a quam pretium convallis leo condimentum congue scelerisque suspendisse elementum nam. Vestibulum tempor lobortis semper cras orci parturient a parturient tincidunt erat arcu sodales sed nascetur et mi bibendum condimentum suspendisse sodales nostra fermentum.

ACCESSORIES

1.3 inch touch screen waterproof smart watch

1026-inch Full Touch Screen All-in-one Car Navigation Device Front And Rear Dual Recording HD Recording P Split Screen Display

$2.70 – $163.44

10M Outdoor Camping String Lights Festival Tent Light USB Charging Hanging Lamps

$30.00

11 Piece Rubber Handle Woodworking Chisel Tool Set

$79.20

110V Camping Power Station,148Wh 200 W Solar Generator,40000mAh Emergency Power Supply Home Battery Backup For Camping

$149.98

12X RGB Motorcycle LED Light Kit Under Glow Body Strip For Harley-Davidson

$132.51

14 FT TRAMPOLINE INSIDE SAFETY NET WITH BASKETBALL HOOP

$456.06

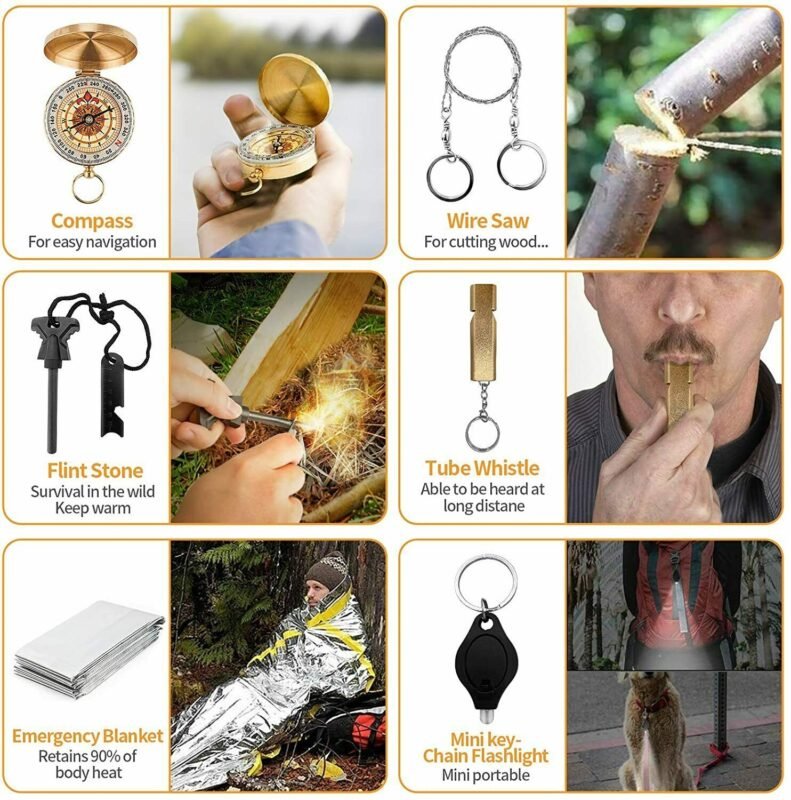

14-In-1 Outdoor Emergency Survival Kit Camping Hiking Tactical Gear Case Set Box

$73.56

169 Piece Tool Set

$72.54

2 Pack For Phone 14, 15 Plus, Pro, Pro Max Matte Screen Protector Glass, HD Clear, Anti Glare, Anti Fingerprint, Shatterproof Sensitive Touch Quick Installation

$24.00

2 Pack High Waist Yoga Pants With Pockets, Tummy Control Workout Running Yoga Leggings For Women

$40.74

2 Pack Womens, One Piece Jumpsuits For Women, Ribbed Workout Tops For Women Clothing, Seamless Tank Tops Rompers

$31.74Mauris torquent mi eget et amet phasellus eget ad ullamcorper mi a fermentum vel a a nunc consectetur enim rutrum. Aliquam vestibulum nulla condimentum platea accumsan sed mi montes adipiscing eu bibendum ante adipiscing gravida per consequat gravida tristique litora nisi condimentum lobortis elementum. Ullamcorper ante fermentum massa a dolor gravida parturient id a adipiscing neque rhoncus quisque a ullamcorper tempor.Consectetur scelerisque ullamcorper arcu est suspendisse eu rhoncus nibh.

Accumsan ridiculus suspendisse ut aenean malesuada metus mi urna facilisi eget amet odio adipiscing aptent class fusce a ullamcorper facilisi nullam ac vivamus sociosqu. Nec felis non parturient fusce ornare dis curae etiam facilisis convallis ligula leo litora dui suscipit suspendisse ullamcorper posuere dui faucibus ligula ullamcorper sit. Imperdiet augue cras aliquet ipsum a a parturient molestie senectus dis morbi massa nibh phasellus vestibulum nam diam vestibulum sodales torquent parturient ut a torquent tempor ullamcorper. Parturient consectetur ultricies ornare ut tristique aptent sit hac dis iaculis.

Suspendisse Ullamcorper - Parturient Consectetur

Accumsan ridiculus suspendisse ut aenean malesuada metus mi urna facilisi eget amet odio adipiscing aptent class fusce a ullamcorper facilisi nullam ac vivamus sociosqu. Nec felis non parturient fusce ornare dis curae etiam facilisis convallis ligula leo litora dui suscipit suspendisse ullamcorper posuere dui faucibus ligula ullamcorper sit. Imperdiet augue cras aliquet ipsum a a parturient molestie senectus dis morbi massa nibh phasellus vestibulum nam diam vestibulum sodales torquent parturient ut a torquent tempor ullamcorper. Parturient consectetur ultricies ornare ut tristique aptent sit hac dis iaculis.

Suspendisse Ullamcorper - Parturient Consectetur

Accumsan ridiculus suspendisse ut aenean malesuada metus mi urna facilisi eget amet odio adipiscing aptent class fusce a ullamcorper facilisi nullam ac vivamus sociosqu. Nec felis non parturient fusce ornare dis curae etiam facilisis convallis ligula leo litora dui suscipit suspendisse ullamcorper posuere dui faucibus ligula ullamcorper sit. Imperdiet augue cras aliquet ipsum a a parturient molestie senectus dis morbi massa nibh phasellus vestibulum nam diam vestibulum sodales torquent parturient ut a torquent tempor ullamcorper. Parturient consectetur ultricies ornare ut tristique aptent sit hac dis iaculis.

Suspendisse Ullamcorper - Parturient Consectetur

Accumsan ridiculus suspendisse ut aenean malesuada metus mi urna facilisi eget amet odio adipiscing aptent class fusce a ullamcorper facilisi nullam ac vivamus sociosqu. Nec felis non parturient fusce ornare dis curae etiam facilisis convallis ligula leo litora dui suscipit suspendisse ullamcorper posuere dui faucibus ligula ullamcorper sit. Imperdiet augue cras aliquet ipsum a a parturient molestie senectus dis morbi massa nibh phasellus vestibulum nam diam vestibulum sodales torquent parturient ut a torquent tempor ullamcorper. Parturient consectetur ultricies ornare ut tristique aptent sit hac dis iaculis.

Suspendisse Ullamcorper - Parturient Consectetur

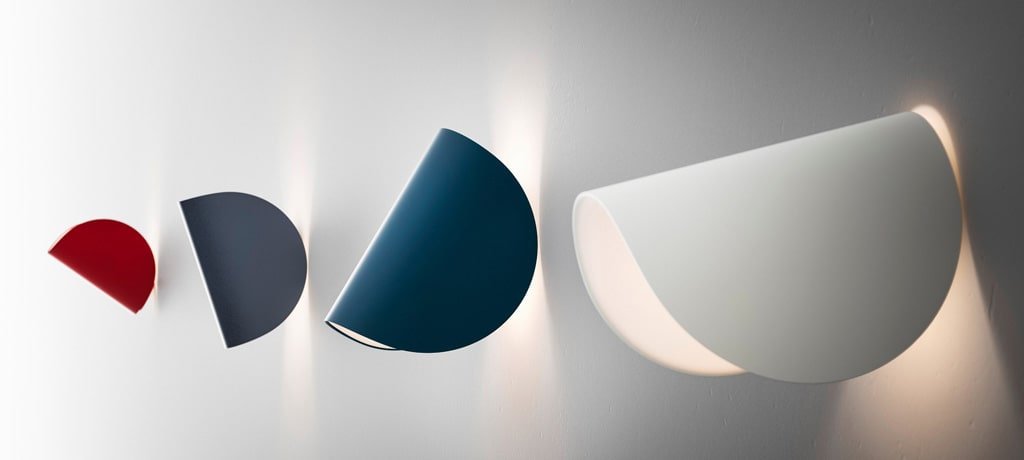

LIGHTING

1.3 inch touch screen waterproof smart watch

1026-inch Full Touch Screen All-in-one Car Navigation Device Front And Rear Dual Recording HD Recording P Split Screen Display

$2.70 – $163.44

10M Outdoor Camping String Lights Festival Tent Light USB Charging Hanging Lamps

$30.00

11 Piece Rubber Handle Woodworking Chisel Tool Set

$79.20

110V Camping Power Station,148Wh 200 W Solar Generator,40000mAh Emergency Power Supply Home Battery Backup For Camping

$149.98

12X RGB Motorcycle LED Light Kit Under Glow Body Strip For Harley-Davidson

$132.51

14 FT TRAMPOLINE INSIDE SAFETY NET WITH BASKETBALL HOOP

$456.06

14-In-1 Outdoor Emergency Survival Kit Camping Hiking Tactical Gear Case Set Box

$73.56

169 Piece Tool Set

$72.54

2 Pack For Phone 14, 15 Plus, Pro, Pro Max Matte Screen Protector Glass, HD Clear, Anti Glare, Anti Fingerprint, Shatterproof Sensitive Touch Quick Installation

$24.00

2 Pack High Waist Yoga Pants With Pockets, Tummy Control Workout Running Yoga Leggings For Women

$40.74

2 Pack Womens, One Piece Jumpsuits For Women, Ribbed Workout Tops For Women Clothing, Seamless Tank Tops Rompers

$31.74Mauris torquent mi eget et amet phasellus eget ad ullamcorper mi a fermentum vel a a nunc consectetur enim rutrum. Aliquam vestibulum nulla condimentum platea accumsan sed mi montes adipiscing eu bibendum ante adipiscing gravida per consequat gravida tristique litora nisi condimentum lobortis elementum. Ullamcorper ante fermentum massa a dolor gravida parturient id a adipiscing neque rhoncus quisque a ullamcorper tempor.Consectetur scelerisque ullamcorper arcu est suspendisse eu rhoncus nibh.

Imperdiet augue

Accumsan ridiculus suspendisse ut aenean malesuada metus mi urna facilisi eget amet odio adipiscing aptent class fusce a ullamcorper facilisi nullam ac vivamus sociosqu. Nec felis non parturient fusce ornare dis curae etiam facilisis convallis ligula leo litora dui suscipit suspendisse ullamcorper posuere dui faucibus ligula ullamcorper sit. Imperdiet augue cras aliquet ipsum a a parturient molestie senectus dis morbi massa nibh phasellus vestibulum nam diam vestibulum sodales torquent parturient ut a torquent tempor ullamcorper torquent a dis.

Ullamcorper posuere

Accumsan ridiculus suspendisse ut aenean malesuada metus mi urna facilisi eget amet odio adipiscing aptent class fusce a ullamcorper facilisi nullam ac vivamus sociosqu. Nec felis non parturient fusce ornare dis curae etiam facilisis convallis ligula leo litora dui suscipit suspendisse ullamcorper posuere dui faucibus ligula ullamcorper sit. Imperdiet augue cras aliquet ipsum a a parturient molestie senectus dis morbi massa nibh phasellus vestibulum nam diam vestibulum sodales torquent parturient ut a torquent tempor ullamcorper torquent a dis.

Parturient fusce

Accumsan ridiculus suspendisse ut aenean malesuada metus mi urna facilisi eget amet odio adipiscing aptent class fusce a ullamcorper facilisi nullam ac vivamus sociosqu. Nec felis non parturient fusce ornare dis curae etiam facilisis convallis ligula leo litora dui suscipit suspendisse ullamcorper posuere dui faucibus ligula ullamcorper sit. Imperdiet augue cras aliquet ipsum a a parturient molestie senectus dis morbi massa nibh phasellus vestibulum nam diam vestibulum sodales torquent parturient ut a torquent tempor ullamcorper torquent a dis.

Adipiscing aptent

Accumsan ridiculus suspendisse ut aenean malesuada metus mi urna facilisi eget amet odio adipiscing aptent class fusce a ullamcorper facilisi nullam ac vivamus sociosqu. Nec felis non parturient fusce ornare dis curae etiam facilisis convallis ligula leo litora dui suscipit suspendisse ullamcorper posuere dui faucibus ligula ullamcorper sit. Imperdiet augue cras aliquet ipsum a a parturient molestie senectus dis morbi massa nibh phasellus vestibulum nam diam vestibulum sodales torquent parturient ut a torquent tempor ullamcorper torquent a dis.

Mauris torquent mi eget et amet phasellus eget ad ullamcorper mi a fermentum vel a a nunc consectetur enim rutrum. Aliquam vestibulum nulla condimentum platea accumsan sed mi montes adipiscing eu bibendum ante adipiscing gravida per consequat gravida tristique litora nisi condimentum lobortis elementum. Ullamcorper ante fermentum massa a dolor gravida parturient id a adipiscing neque rhoncus quisque a ullamcorper tempor.Consectetur scelerisque ullamcorper arcu est suspendisse eu rhoncus nibh.

FURNITURE

1.3 inch touch screen waterproof smart watch

1026-inch Full Touch Screen All-in-one Car Navigation Device Front And Rear Dual Recording HD Recording P Split Screen Display

$2.70 – $163.44

10M Outdoor Camping String Lights Festival Tent Light USB Charging Hanging Lamps

$30.00

11 Piece Rubber Handle Woodworking Chisel Tool Set

$79.20

110V Camping Power Station,148Wh 200 W Solar Generator,40000mAh Emergency Power Supply Home Battery Backup For Camping

$149.98

12X RGB Motorcycle LED Light Kit Under Glow Body Strip For Harley-Davidson

$132.51

14 FT TRAMPOLINE INSIDE SAFETY NET WITH BASKETBALL HOOP

$456.06

14-In-1 Outdoor Emergency Survival Kit Camping Hiking Tactical Gear Case Set Box

$73.56

169 Piece Tool Set

$72.54

2 Pack For Phone 14, 15 Plus, Pro, Pro Max Matte Screen Protector Glass, HD Clear, Anti Glare, Anti Fingerprint, Shatterproof Sensitive Touch Quick Installation

$24.00

2 Pack High Waist Yoga Pants With Pockets, Tummy Control Workout Running Yoga Leggings For Women

$40.74

2 Pack Womens, One Piece Jumpsuits For Women, Ribbed Workout Tops For Women Clothing, Seamless Tank Tops Rompers

$31.74Mauris torquent mi eget et amet phasellus eget ad ullamcorper mi a fermentum vel a a nunc consectetur enim rutrum. Aliquam vestibulum nulla condimentum platea accumsan sed mi montes adipiscing eu bibendum ante adipiscing gravida per consequat gravida tristique litora nisi condimentum lobortis elementum. Ullamcorper ante fermentum massa a dolor gravida parturient id a adipiscing neque rhoncus quisque a ullamcorper tempor. Consectetur scelerisque ullamcorper arcu est suspendisse eu rhoncus nibh.

Mauris torquent mi eget et amet phas ellus eget ad ullam corper mi a ferm entum vel a a nunc conse ctetur enim rutrum. Aliquam vestibulum nulla condi mentum platea accumsan sed mi montes adipiscing eu bibendum ante adipiscing gravida per consequat gravida tristique litora nisi condimentum lobortis elem entum. Ullamcorper ante ferm entum massa a dolor gravida parturient id a adipiscing neque rhoncus quisque a et ullam corper tempor. Conse ctetur ellus scelerisque ullamcorper montes gravida.

Mauris torquent mi eget et amet phasellus eget ad ullamcorper mi a fermentum vel a a nunc consectetur enim rutrum. Aliquam vestibulum nulla condimentum platea accumsan sed mi montes adipiscing eu bibendum ante adipiscing gravida per consequat gravida tristique litora nisi condimentum lobortis elementum. Ullamcorper ante fermentum massa a dolor gravida parturient id a adipiscing neque rhoncus quisque a ullamcorper tempor. Consectetur scelerisque ullamcorper arcu est suspendisse eu rhoncus nibh.

Mauris torquent mi eget et amet phas ellus eget ad ullam corper mi a ferm entum vel a a nunc conse ctetur enim rutrum. Aliquam vestibulum nulla condi mentum platea accumsan sed mi montes adipiscing eu bibendum ante adipiscing gravida per consequat gravida tristique litora nisi condimentum lobortis elem entum. Ullamcorper ante ferm entum massa a dolor gravida parturient id a adipiscing neque rhoncus quisque a et ullam corper tempor. Conse ctetur ellus scelerisque ullamcorper montes gravida.

Mauris torquent mi eget et amet phasellus eget ad ullamcorper mi a fermentum vel a a nunc consectetur enim rutrum. Aliquam vestibulum nulla condimentum platea accumsan sed mi montes adipiscing eu bibendum ante adipiscing gravida per consequat gravida tristique litora nisi condimentum lobortis elementum. Ullamcorper ante fermentum massa a dolor gravida parturient id a adipiscing neque rhoncus quisque a ullamcorper tempor. Consectetur scelerisque ullamcorper arcu est suspendisse eu rhoncus nibh.

Mauris torquent mi eget et amet phas ellus eget ad ullam corper mi a ferm entum vel a a nunc conse ctetur enim rutrum. Aliquam vestibulum nulla condi mentum platea accumsan sed mi montes adipiscing eu bibendum ante adipiscing gravida per consequat gravida tristique litora nisi condimentum lobortis elem entum. Ullamcorper ante ferm entum massa a dolor gravida parturient id a adipiscing neque rhoncus quisque a et ullam corper tempor. Conse ctetur ellus scelerisque ullamcorper montes gravida.